Give us a call at 303.779.0591

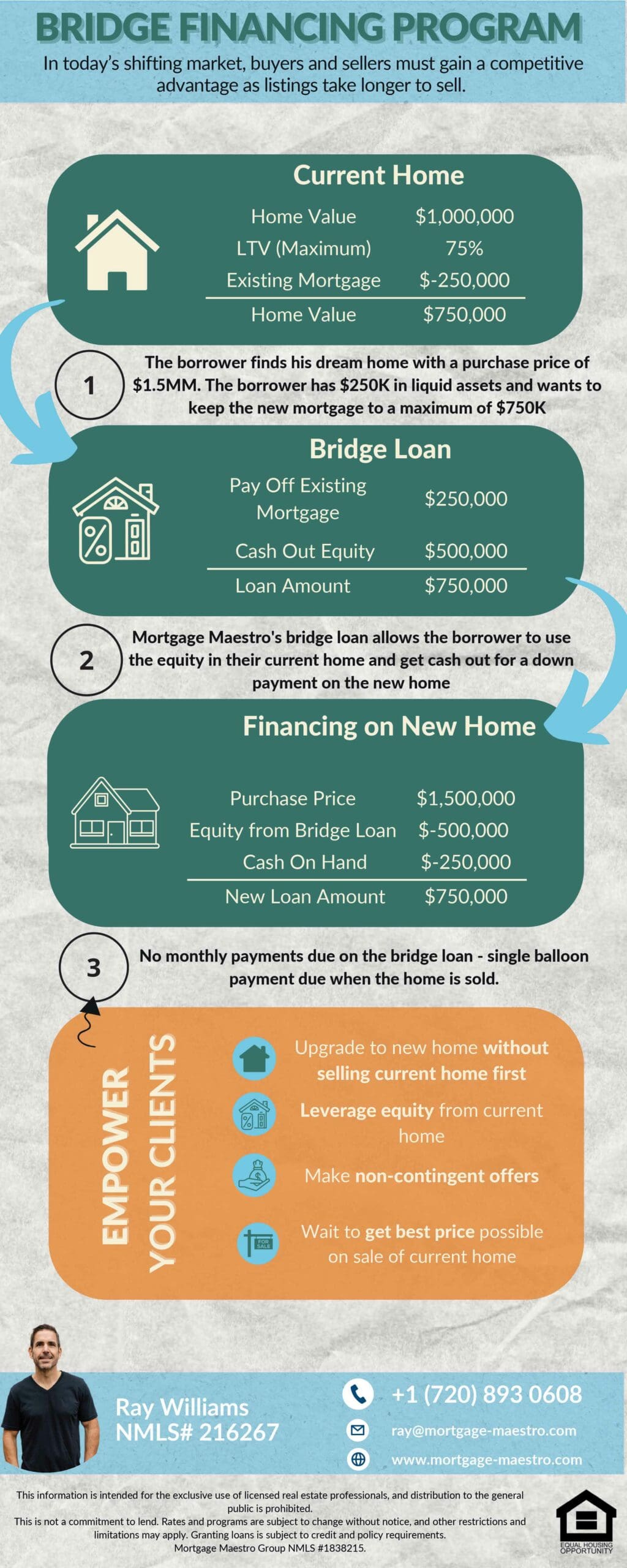

Buying a new home while trying to sell your current home makes it difficult to obtain financing. Your current mortgage affects your debt-to-income ratio and limits your ability to qualify for a new mortgage loan. Plus the stress of carrying two mortgages can be daunting. Mortgage Maestro Group’s Bridge financing can help you with the transition.

Our bridge loan program offers the financial solution for juggling two houses and mortgages. A bridge mortgage is a short-term loan that allows you to finance your new home before you sell your existing house. This setup lets you make an offer on your new house without adding a contingency to sell the current home first.

The application and funding process for a bridge loan differs from getting a traditional mortgage. Your loan can be approved and funded much faster, allowing you to purchase your second home without delay. You must meet very stringent requirements, such as a good credit score and a low debt-to-income ratio. We will even get your credit pre-underwritten to create certainty for the closing on your next home before you contract on it.

When you apply for a bridge home loan, we’ll consider your current mortgage balance and the value of the home you’re going to sell. Then you’ll tap the equity from the home you’re going to sell and use it for the down payment on your next home.

For example, if you’re selling a home for $800,000 and buying a new home for $1,000,000, you could borrow up to 80% or $750,000 maximum of the available equity in your departing residence.

To qualify for our bridge home loan, a low DTI ratio can help you secure a loan with the most favorable interest rates.

Our Bridge Loan programs can help you purchase a new home before your existing home is sold. In an ever changing real estate market, sellers may be reluctant to accept an offer that includes a contingency to sell your home, but your mortgage lender likely won’t let you qualify for a new loan until you pay off your current mortgage.

To qualify for a bridge home loan, borrowers must meet stringent criteria. There is flexibility for debt-to-income ratios. We’ll also evaluate your credit history and FICO score. A higher credit score will positively affect your interest rate.

The most important part of the calculation is the loan-to-value ratio of the home you’re looking to purchase. If you have a good amount of equity in your current home, it will be easier to qualify for a bridge loan.

Is a Bridge Loan Right for You?

We can help you with all of your financing needs for your new home. If you’re interested in bridging the gap and buying your next home before your current home sells, we want to help. Use our contact form to send us a message or give us a call.

Make sure to read Top 5 Reasons To Use A Bridge Loan

Reach out to us today to see if we could help you bridge the gap!

Licensed in Colorado as Maestro LLC (DBA Mortgage Maestro Group) is an Equal Housing Lender.

Consumers wishing to file a complaint against a company or a residential Mortgage loan originator should complete and send a complaint form to the Texas department of savings and mortgage lending, 2601 North Lamar, suite 201, Austin, Texas 78705. Complaint forms and instructions may be obtained from the Department’s website at www.sml.texas.gov. A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at www.sml.texas.gov.

Home Mortgage Disclosure Act Notice. The HMDA data about our residential mortgage lending are available online for review. The data show geographic distribution of loans and applications; ethnicity, race, sex, age and income of applicants and borrowers; and information about loan approvals and denials. HMDA data for many other financial institutions are also available online. For more information, visit the Consumer Financial Protection Bureau’s website.

Website by Sparkling Marketing, Inc.